Around 520 billion banknotes (source: SNB) and around 5.9 billion coins (source: Swissmint) are in circulation in Switzerland. Cash is the second most popular means of payment in Switzerland and around a quarter of all transactions are carried out with cash (which is, of course, the only legal tender in Switzerland). As the number of bank branches continues to fall, the availability of cash is concentrated on ATMs. As the ATM network in Switzerland is also being further reduced, availability and security at the remaining ATM locations will become even more important. To ensure that these ATMs (which, according to Six, cost around CHF 30,000 per year per machine) remain available for cash transactions at all times, efficient and secure cash logistics that keep pace with market and technological developments are essential.

Safety comes first

Security is undoubtedly the top priority in cash logistics. This applies not only to the ATM, but also to the entire logistics chain from the provision of the National Bank, transport to counting, sorting and distribution centers, transport to and from the ATM and the transaction itself. State-of-the-art, networked technical equipment on properties, vehicles and security personnel, together with the strictest process compliance and regular training, ensure that we are always several steps ahead of the criminal elements.

Efficient processes and optimization

Efficiency is another key to successful cash logistics. Only holistic cooperation between cash logistics providers, technology providers and financial service providers can be optimized efficiently. A technically flawless vending machine without money is just as useless as a vending machine filled with money but not working due to a fault. Cooperation is the key to availability. This cooperation in planning, on site and in monitoring is one of the most important efficiency enhancers in the ATM business.

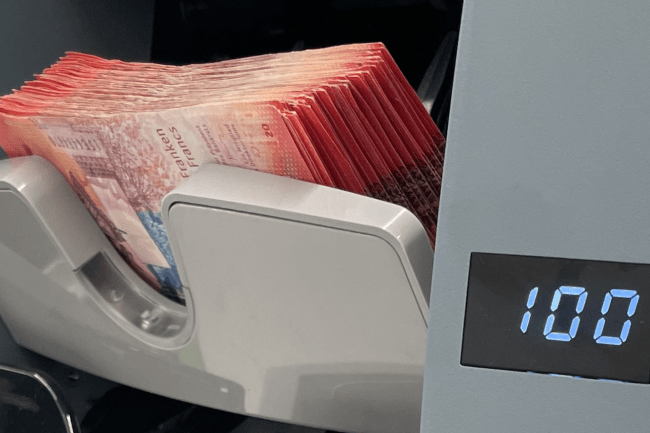

By the way: Did you know that the current Swiss banknotes are almost 25% thicker than the last issues?

In the end, around 25% of the banknote capacity in ATMs disappeared overnight when the new notes were issued.

The new notes are more durable and safer.

Together in the service of bank customers

Cash logistics is no longer a core competence of banks. Nevertheless, banks must give their customers access to cash. And not only as part of the customer service, but also quite simply because banks (and Swiss Post in particular) thus fulfill a basic service mandate from the federal government. However, this is carried out by the technology providers (from ATMs to counting and sorting systems) and by the security logistics providers as well as by the employees in the cash processing centers of banks, retailers, transport companies and security logistics providers.

Conclusion

In summary, it can be said that cash logistics in Switzerland require high security standards and optimized processes in order to meet the needs of bank customers. The banks, supported by specialized service providers, thus continue to fulfill their basic supply mandate and ensure that cash is available everywhere and at all times.