SIX and Diebold Nixdorf are cooperating to help ensure the supply of cash in Switzerland in the future. They are focusing on efficiency gains. In future, ATMs are to be operated by a separate network. The announcement is likely to be entirely in the interests of the National Bank.

The financial market infrastructure provider SIX and the payments technology company Diebold Nixdorf are pooling their expertise in cash supply and the operation of ATMs (for which the communiqué of Tuesday the Anglo-Saxon abbreviation ATMs).

By “combining know-how, technology and a broad partner network, the two companies have jointly developed a new approach to the challenges facing the market”, according to the best marketing jargon.

It will work with innovative partners such as Helveticor (a provider in the field of high-security logistics) to evaluate “how cash logistics can be made more sustainable and efficient”.

FEWER AND FEWER BRANCHES AND ATMS

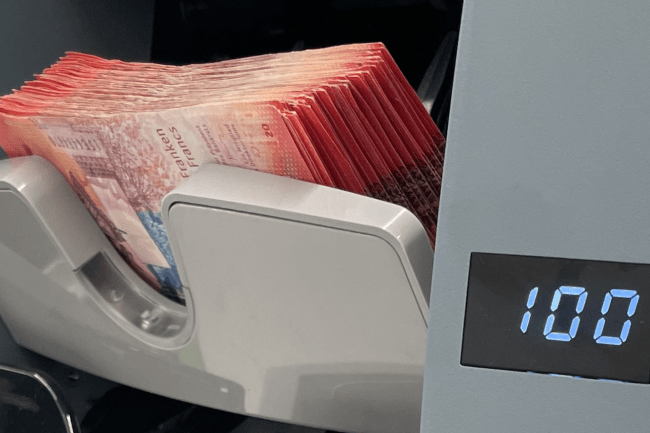

The serious background to the announcement is the advancing digitalization of payment transactions, which can also be observed in everyday life. Cash and cash supply are adapting to the changes in the market, notes SIX. In Switzerland, cash is still highly valued by large sections of the population, but the disappearance of bank and post office branches and ATMs is having an impact on its availability.

According to SIX, between 2015 and 2023, the number of bank branches fell from 3,100 to 2,600 and the number of post offices from 1,500 to 800. At the beginning of 2000, there were still 7,200 ATMs in operation; today there are fewer than 6,400.

IN THE FIGHT AGAINST THE NEGATIVE SPIRAL

According to SIX, this development entails the risk that the costs of supplying cash will rise, that the banks as ATM operators will come under further pressure and that the costs of providing the corresponding infrastructure will be driven up as a result – and thus apparently shares the concerns of the Swiss National Bank (SNB) about a negative spiral in the cash sector.

The cooperation between SIX and Diebold Nixdorf should now help to ensure a broad cash supply in Switzerland in the long term.

Together, they will cover the entire cash supply value chain.

Nothing should change for ATM users, but banks should benefit from leaner processes.

The aim is to achieve efficient cash management by offering all relevant operating and management services from a single source.

making cash management more efficient with atm pooling

The buzzword for this is “ATM pooling”. This means that the Swiss banks that currently operate the ATMs will bring them into a separately operated network.

And SIX explains: “The main task of such a network would be to optimize the operation of ATMs in terms of geographical coverage, operation and cash logistics so that the Swiss banks can continue to guarantee their customers and ATM users comprehensive access to cash.”

In September, an event is to be held with Swiss banks as ATM operators to discuss the requirements for implementing ATM pooling.

THE NOT ENTIRELY INVISIBLE HAND OF THE NATIONAL BANK

So far, SIX has not attracted much public attention as a staunch defender of banknotes and coins – which is probably due to the fact that it also operates the infrastructure for cashless payment transactions and offers services relating to card and mobile transactions.

The issue of the availability and acceptance of cash is increasingly preoccupying Swiss politicians, with two popular initiatives on the subject. Two popular initiatives have been launched. The SNB has subsequently made it clear that it does not want to accept a negative spiral in the cash sector. The announcement by SIX and Diebold Nixdorf can therefore also be interpreted as the result of more or less gentle pressure from the SNB.

Source: https://www.finews.ch/news/finanzplatz/64048-six-bargeldversorgung-diebold-nixdorf-bancomaten-helveticor-snb