Less overhead, more efficiency: how centralised cash processes reduce your costs

Cash logistics not only generates direct costs. The internal efforts involved – often underestimated – span multiple departments. Security, cash management, and branch management are all involved at the same time, tying up resources and complicating workflows. In addition, qualified staff are tasked with duties such as counting cash instead of focusing on core business activities. Without central responsibility, unnecessary friction and hidden costs arise. This makes clear responsibilities, streamlined processes, and a single-source solution all the more important.

More freedom for your teams – thanks to efficient cash processes

Staff are one of a company’s most valuable resources. Whether in retail or banking, well-trained employees make a significant contribution to business success. All the more important, then, that they can focus on their core tasks. In practice, however, the reality is often different: cash processes tie up a disproportionate amount of internal capacity – often without this being clearly reflected in cost accounting.

5 typical internal workloads in cash handling

1. Daily closing by sales staff

Sales or cashier staff often handle the daily closing, which involves counting, checking, and reconciling cash. These tasks are usually carried out under time pressure and without technical tools such as smart safes or automated cash systems. This not only increases the risk of errors but also ties up valuable time that could be spent on customer service or revenue-generating activities.

2. Cash transport by managers

Branch managers, managing directors, or team leaders often personally take cash to the bank or post office. In addition to the obvious security risk – such as robbery or loss – this involves a considerable time investment. These trips disrupt business operations, reduce the on-site availability of managers, and result in hidden personnel costs.

3. Decentralised cash handling

Small, internal cash handling points require costly security measures such as certified safes, cameras, counting systems, access controls, and the four-eyes principle. Ongoing costs are high, and responsibility is spread across many internal units, fostering inefficiencies. In addition, the risk increases that standards will be applied inconsistently, creating security gaps.

4. High coordination effort

Multiple departments – from security and cash management to controlling and logistics – must plan, monitor, and coordinate cash flows. Every incident, whether a discrepancy or delay, creates additional need for coordination, follow-up queries, and process interruptions. This results in extra workload, ties up resources, and lengthens decision-making paths, reducing overall efficiency.

5. Non-transparent fixed costs

Internal costs for personnel, infrastructure, and security requirements often do not appear in direct comparisons with external services but they are very real.

Solution: Specialised outsourcing reduces internal overheads

What many companies classify as “overhead” is part of the daily core business for specialised service providers like Helveticor. Employees no longer need to be deployed for counting, sorting, or transporting cash and can instead focus on customer-facing and strategically relevant activities.

Cash logistics thus becomes not only secure but also efficient:

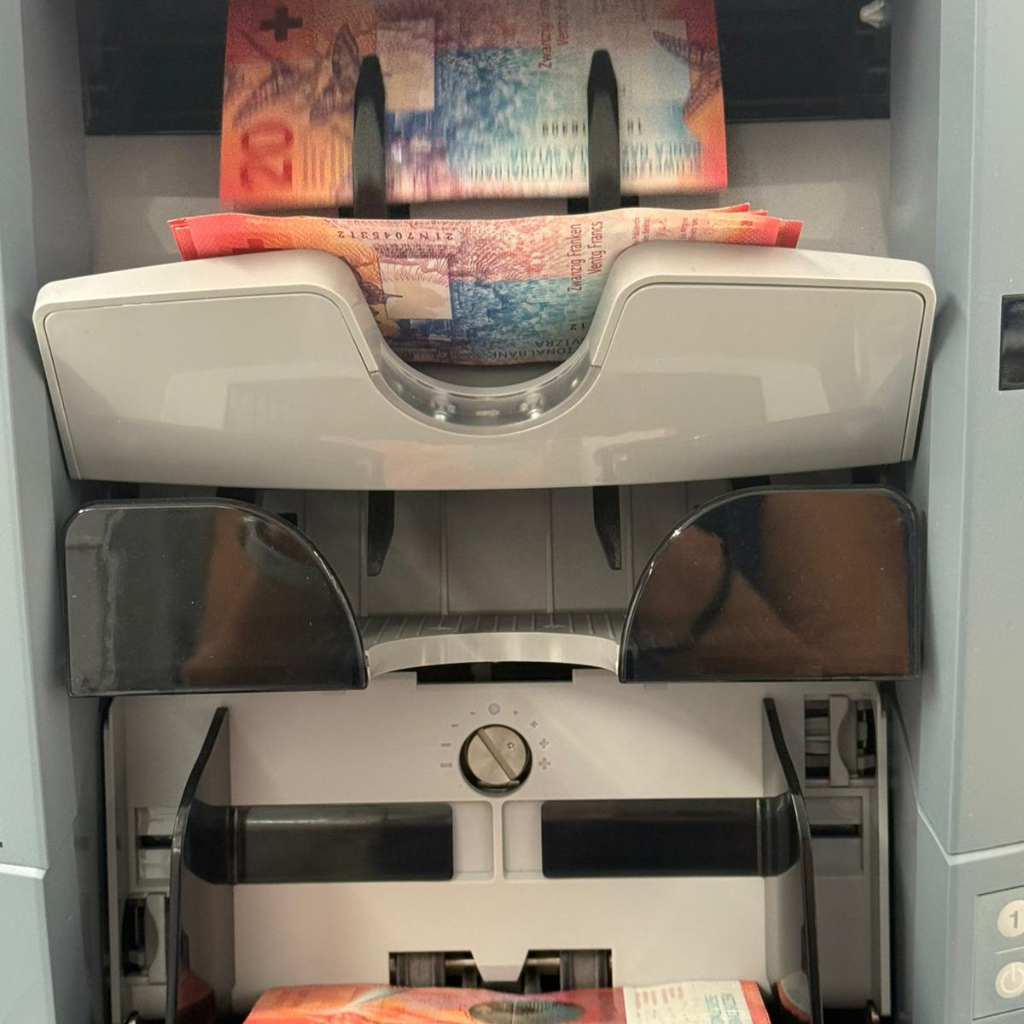

- Cash is processed directly on-site via validating smart safes

- Transport and storage are carried out via structured, secure routes

- The entire process, from deposit to crediting the account, is managed from a single source

Helveticor relies on specially trained professionals as well as state-of-the-art, secure infrastructure. In addition, it has access to the resources of its parent company, Planzer – an established logistics provider with nationwide coverage.

Result: Less coordination, more focus on what matters most

By centralising and standardising all cash processes, not only can direct process costs be reduced, but internal efforts and interdepartmental coordination are also largely eliminated.

This means:

- Reduced staffing requirements for administrative tasks

- Enhanced on-site security infrastructure

- Clear responsibilities and transparent processes

- Greater planning reliability and lower error rates

The challenges surrounding cash processes are often self-inflicted and can be significantly mitigated through smart outsourcing. What is currently spread across multiple internal departments can be made reliable, transparent, and efficient through a centralised service. This not only reduces direct process costs but, more importantly, also cuts hidden internal efforts. At the same time, companies regain valuable resources – in terms of staff, time, and strategic capacity.

With a single-source solution, security requirements, reliability, and cost control can be brought into alignment – creating a cash process that keeps pace with real-world demands.